- More than 2 years ago

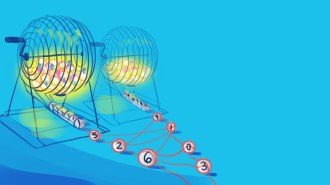

The Super Bowl theory links stock market performance to the results of the championship football game, held each January since 1967. It holds that if a team from the original National Football League wins the title, the stock market increases for the rest of the year, and if a team from the old American Football League wins, the stock market goes down.

Economist Paul M. Sommers of Middlebury (Vt.) College has analyzed the data for the years from 1967 to 1998. His mathematical model suggests that the stock market posts a significantly higher gain if the Super Bowl winner is from the National Football Conference Western Division. Moreover, the higher the combined team point totals are, the lower the percentage change in the Dow Jones Industrial Average.

At the same time, Sommers’ model shows that the Super Bowl theory’s predictive power has declined precipitously in recent years. “Despite the Super Bowl theory’s surprisingly strong early record, reading the sports page now is not making it any easier to read economic tea leaves,” Sommers concludes in the May College Mathematics Journal.