- More than 2 years ago

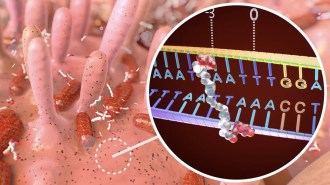

In March 2002, an international team of scientists pumped hot water down a 1,200-meter well located at the edge of the Mackenzie River Delta in northwestern Canada. The water seeped into the pores of the perpetually frozen sediments, melting icelike crystals along its path. These were no ordinary crystals, but frozen cages of water molecules filled with methane, the main constituent of natural gas. The structures had formed millennia ago and now reside in layers deep below the permafrost. As the crystals melted, the natural gas escaped and bubbled to the surface to fuel a flame rising high above the white Arctic landscape.

“It was a landmark effort,” says Dendy Sloan of the Colorado School of Mines in Golden. It produced the first documented field demonstration that natural gas could be released from the crystalline substances known as methane hydrates.

At first glance, this unconventional source of natural gas looks like ordinary ice. But place a match next to the ice and it burns. Over the past several decades, scientists have identified dozens of gas-hydrate accumulations around the world (SN: 11/14/98, p. 312: http://www.sciencenews.org/pages/sn_arc98/11_14_98/bob1.htm). Some say that worldwide there could be twice as much energy stored in hydrates as in all the other known energy resources combined, including coal, oil, and conventional natural gas deposits.

As Timothy Kneafsey of the Lawrence Berkeley (Calif.) National Laboratory puts it, “Hydrates could be a giant source of energy in the future. It’s something that’s just waiting to happen.”

The catch is that hydrates are hard to harvest. They sit hundreds of meters below the permafrost in the northern latitudes and, in even greater abundance, in sediments beneath the ocean floor. What’s more, the gas is locked in place under low temperatures and high pressures, which make this icy source of energy difficult to tap. In fact, until recently, no one knew whether it was technically possible to recover significant amounts of natural gas from hydrates, let alone do it in an economically feasible manner.

The successful effort in the Mackenzie Delta, however, has energized the prospects for a methane-hydrate industry. Results from recent geological surveys of concentrated deposits of gas hydrates in Alaska and off the coast of Japan also suggest that methane hydrates are likely to become a viable future source of clean-burning natural gas.

“The volume of gas contained in gas hydrates is staggering,” says Scott Dallimore of the Canadian Geological Survey in Sidney, British Columbia. “As a source of natural gas over the next several decades, [methane hydrates] now seem more possible.”

Hydrate origins

Although new as a potential energy source, hydrates have long been objects of scientific curiosity. “The funny thing is that [studies of] hydrates predate modern chemistry by almost 100 years,” says John Ripmeester, a physical chemist at the Canadian National Research Council in Ottawa.

The English chemist Sir Humphrey Davy made the world’s first known hydrates in his laboratory in 1811. It wasn’t until 1965 that scientists discovered these crystalline structures in nature, under the permafrost in Siberia.

Gas hydrates are unusual in that the icy structures can form at temperatures well above the freezing point of ordinary ice. This occurs only when high pressures squeeze chilled water-and-gas molecules into a solid. Although hydrates can contain whatever gas might be present in a sediment—including carbon dioxide, hydrogen sulfide, and larger hydrocarbons such as ethane and propane—methane hydrates are by far the most common hydrates in nature.

In the permafrost, hydrates form when heat from Earth’s core cooks deeply buried organic matter, releasing methane. The gas percolates up through sediments until it encounters a zone where the combination of pressure and temperature favors the formation of hydrates.

In those marine sediments where hydrates form, bacteria generate methane as they break down organic matter.

What makes these hydrates golden to energy producers is their capacity to store vast amounts of burnable gas. One cubic meter of methane hydrate can contain the amount of natural gas that would fill approximately 164 cubic meters at standard room temperature and pressure.

Global estimates of how much methane is tied up in hydrates vary drastically. Figures range over several orders of magnitude, from about 2.8 x 1015 to 8 x 1018 trillion cubic meters of gas. One frequently cited comparison suggests that the amount of hydrate-bound gas is 100 times as great as that of conventional natural gas resources.

What’s more, about one quarter of the world’s hydrates reside within the borders of the United States, in places such as the Alaskan North Slope, the Gulf of Mexico, and Blake Ridge off the coast of South Carolina. According to the U.S. Department of Energy, if only 1 percent of the methane stored in these hydrates could be recovered, it would more than double the current domestic supply of natural gas.

U.S. consumption of natural gas has been increasing rapidly over the past several decades. That trend is expected to continue as demand increases for clean-burning fuels that produce little carbon dioxide—the most important greenhouse gas driving climate change. At the same time, domestic production of natural gas is expected to fall short of demand as soon as 2020, according to a recent report by the Department of Energy’s Energy Information Administration.

With an eye on staving off this crunch, Congress in 2000 passed the Methane Hydrate Research and Development Act, injecting close to $50 million into a 5-year program in hydrate research. The fate of that effort is now back in the hands of Congress, which is considering whether or not to renew the funding.

For countries such as Japan and India, which have hydrates off their coasts and few other energy resources, the push for gas hydrates is a priority. Currently, these countries must pay a premium to import fuel from other countries.

Expanding the use of natural gas and securing Japan’s domestic supply “are important pillars of the government’s energy policy,” says Yoshihiro Tsuji of the Japan Oil, Gas and Metals National Corporation. Between 2001 and 2004, the country’s government spent $160 million on researching and developing methane hydrates, says Tsuji. The government plans to spend another $40 million by the end of this year, he adds.

Drill team

Japan played an active role in the production test in Canada’s Mackenzie River Delta. The drilling site, called Mallik, overlies one of the most concentrated gas-hydrate reservoirs known in the world. Up to 80 percent of the sediment’s pores are filled with methane hydrates.

This subterranean labyrinth of frozen energy, located between 900 and 1,100 m below the surface, is also the best characterized of all deposits. In the early 1970s, scientists from the Canadian company Imperial Oil first documented gas hydrates at this location.

The Mallik test in 2002 was a scientific success, despite being “an amazing logistical challenge,” says Dallimore. About 100 scientists and engineers from Japan, Canada, the United States, India, and Germany gathered in the Arctic for a 5-month-long adventure.

It began in the fall of 2001, when the international team sent 165 tons of gear by barge from Great Slave Lake, just north of Alberta in the Northwest Territories, down the Mackenzie River. At the end of its 1,800-kilometer journey to the river’s delta, the gear was unloaded 17 km from the Mallik site. A group of local Inuit workers had laid down ice roads so that trucks could transport the heavy equipment to its destination.

After 2 months of laborious preparations in the Arctic, where temperatures frequently dropped to –45°C, engineers working in 24-hour darkness finally set up the drill rig. “We spudded the first well on Christmas Day,” recalls Dallimore.

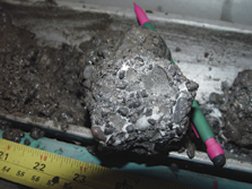

Each time the researchers pulled a 6 m-long, 7.5-centimeter-wide core of black, sandy material out of the ground, the core’s surface fizzled as gas escaped from the hydrates. To preserve hydrates for future studies, the researchers sealed some cores inside special pressure- and temperature-controlled canisters.

The greatest excitement came when the team released methane gas from the buried hydrates in a way that could be used on a large scale. The idea was to create conditions that would destabilize the hydrates so that they melted into water mixed with methane. In the first try, the scientists lowered an oil field device down the well that drew down the pressure within the sediments, much as one slowly opens the cap of a carbonated drink. The device also monitored the flow of gas and water as the hydrates broke down.

Although the test lasted only a few hours, it revealed how quickly the sediments responded to depressurization, how fast the water and gas flowed into the well, and the strength and permeability of the sediments. These factors determine the rate at which gas can be recovered from hydrates, says Dallimore. The team is currently plugging the data into computer models to figure out the most energy-efficient approach.

The Mallik team also tested a second recovery technique. In this dramatic field experiment, lasting 5 days, water heated to 70°C melted the hydrates. The crew then pumped the gas-bearing liquid to the surface, separated out the methane, and shunted it to a flaring tower.

Although it will take longer tests to determine whether natural gas from hydrates can be recovered on a commercial basis, “it was the first proof of concept to show that it’s technically possible to produce combustible gas from hydrates,” says Sloan.

Under the sea

Ironically, it isn’t methane hydrates’ promise as an energy resource that’s been driving oil-and-gas–industry research. Gas hydrates can be a nuisance when drilling for offshore deposits of conventional gas. As companies deeply penetrate the ocean floor, they often encounter zones filled with hydrates that can clog their pipelines, shutting down production for days. The industry spends roughly $1 billion annually unclogging pipelines and trying to prevent blockages from forming in the first place.

“It’s an imminent cause of concern,” says Sloan. “That’s what’s funded the research over the last 70 years or so.”

Most of that research has taken place in labs, where scientists have been investigating the properties of these strange crystalline structures. And although the science has come a long way, fundamental questions remain unanswered. For instance, how do hydrates interact with sediments, and what factors influence their formation?

The differences between marine and permafrost hydrates also remain puzzling. Methane-hydrate deposits at the bottom of the ocean are much less concentrated than permafrost accumulations are. On average, only a few percent of marine-sediment pores are filled with hydrates, so it would be difficult to extract them efficiently.

To figure out why marine hydrates are so sparsely distributed, researchers have been making synthetic methane hydrates inside large tanks filled with water and sand. By controlling the temperature, pressure, and salinity within the vessels, the researchers can simulate conditions at the bottom of the ocean and watch hydrates grow or disintegrate under varying conditions.

At the Pacific Northwest National Laboratory in Richland, Wash., Pete McGrail and his colleagues use ultrasound to probe their homegrown hydrates. They have found that the size of the pores between the sand grains influences the formation of gas-bearing ice crystals, with smaller pores yielding fewer crystals.

McGrail explains that as the hydrates grow, they exclude salt from their structures and make the remaining water in the pore saltier. Because salt lowers water’s freezing point, the leftover water can no longer solidify into crystalline structures at the local temperature, and therefore it remains liquid. The larger the pores, the longer it takes to reach this cutoff, and thus the more hydrates form, he notes.

Future prospects

Once scientists figure out how to recover natural gas efficiently from dispersed hydrates in the marine environment, these gas-filled crystals could become an important global source of energy. That could take decades, says Dallimore.

In the meantime, small-scale commercial benefits could show up in places such as Alaska’s North Slope. This region not only harbors several large concentrated sources of hydrates, but also has an established infrastructure for oil-and-gas development, says Timothy Collett of the U.S. Geological Survey in Denver.

BP Exploration (Alaska) and the Department of Energy have already begun assessing the economic potential of gas-hydrate accumulations on the North Slope. One deposit near the Prudhoe Bay oil field, known as the Eileen trend, contains more than 1.2 trillion cubic meters of gas. That’s twice the total amount of natural gas consumed annually in the United States, says Collett. When combined with conventional sources of natural gas, it’s a potential resource that could last for years.

What’s more, computer models suggest that large amounts of gas could be recovered from the North Slope at a high-enough rate for hydrates to be economically competitive with conventional natural gas.

BP Exploration hasn’t yet decided whether to pursue development of gas hydrates on the North Slope. Bearing on that decision will be the outcome of discussions among oil-and-gas producers, U.S.- and Canadian-government officials, native communities, and environmentalists about building a gas pipeline from the North Slope to the lower 48 states.

“If hydrates could contribute to the pipeline, that would be good to know,” says Collett. It would strengthen arguments in favor of the pipeline’s $19 billion construction. Furthermore, having a pipeline would make the development of gas hydrates more appealing.

As that discussion unfolds, scientists in Japan have also been edging toward commercial gas production at a hydrate deposit called the Nankai Trough off the country’s eastern coast. Last year, a crew drilled through the site and extracted hydrate-bearing core samples. Analyses showed that, surprisingly, 60 to 70 percent of the sediments’ pores were filled with hydrates, says Tsuji.

Starting in 2007, the Japanese team plans to begin production tests to assess the economic potential of the Nankai Trough. If all goes well, Tsuji says, the site could be producing methane by 2016.